How Much Can You Contribute To A Roth Ira 2025. The more money you contribute to a roth ira, the. For 2023, the total contributions you make each year to all of your traditional iras and roth iras can't be more than:

For 2023, you can contribute $6,500 a year across all your iras if you’re under 50, or $7,500 if you’re 50 and. How much can you contribute to a roth ira in 2025?

Some Employers Even Offer A Roth Version Of The 401 (K) With No Income Limits.

For 2023, you can contribute $6,500 a year across all your iras if you’re under 50, or $7,500 if you’re 50 and.

The More Money You Contribute To A Roth Ira, The.

How much should you contribute to your roth ira in 2025?

The Irs Allows You To Put More Cash Into A Roth Ira In 2025.

In 2025, the most you can contribute to all of your iras (traditional and roth combined) is $7,000.

Images References :

Source: fancyaccountant.com

Source: fancyaccountant.com

What is a Roth IRA? The Fancy Accountant, What are the roth ira income limits for 2025? $6,500 ($7,500 if you're age 50 or older), or if.

Source: www.bestpracticeinhr.com

Source: www.bestpracticeinhr.com

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, The irs allows you to put more cash into a roth ira in 2025. For 2025, the roth ira’s contribution limit is $7,000.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS announced its Roth IRA limits for 2022 Personal, That's up from $6,500 in 2023. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

Roth IRA Benefits, Rules, and Contribution Limits 2025, How much should you contribute to your roth ira in 2025? Story by charlene rhinehart, cpa • 2mo.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2023 Finance Strategists, The annual contribution limit for the 2025 tax year is $7,000, up from $6,500 in 2023. In 2025, the max ira contribution you’re able to make is $7,000.

Roth IRA Who Can Contribute? The TurboTax Blog, As shown above, single individuals enter the partial contribution range when magi reaches $146,000 in 2025, up from $138,000 in 2023. If you are 50 and older, you can contribute an.

Source: staging.solo401k.com

Source: staging.solo401k.com

How to Convert Traditional IRA Funds to Roth Solo 401k, A roth ira conversion is the process of rolling funds from a pretax retirement account into a roth ira. For 2023, the total contributions you make each year to all of your traditional iras and roth iras can't be more than:

Source: www.youtube.com

Source: www.youtube.com

How much can I contribute to my Roth IRA 2023 YouTube, $6,500 ($7,500 if you're age 50 or older), or if. How much should you contribute to your roth ira in 2025?

Source: fancyaccountant.com

Source: fancyaccountant.com

What is a Roth IRA? The Fancy Accountant, And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older. As shown above, single individuals enter the partial contribution range when magi reaches $146,000 in 2025, up from $138,000 in 2023.

Roth IRA Who Can Contribute? The TurboTax Blog, The annual contribution limit for the 2025 tax year is $7,000, up from $6,500 in 2023. For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for.

In 2025, You Can Contribute $7,000 Per Year To An Ira, Whether It Is A Traditional Ira Or A Roth Ira Or A Combination Of The Two.

The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

For 2025, The Irs Has Raised The Limits On How Much Money You Can Put Into A Roth Ira.

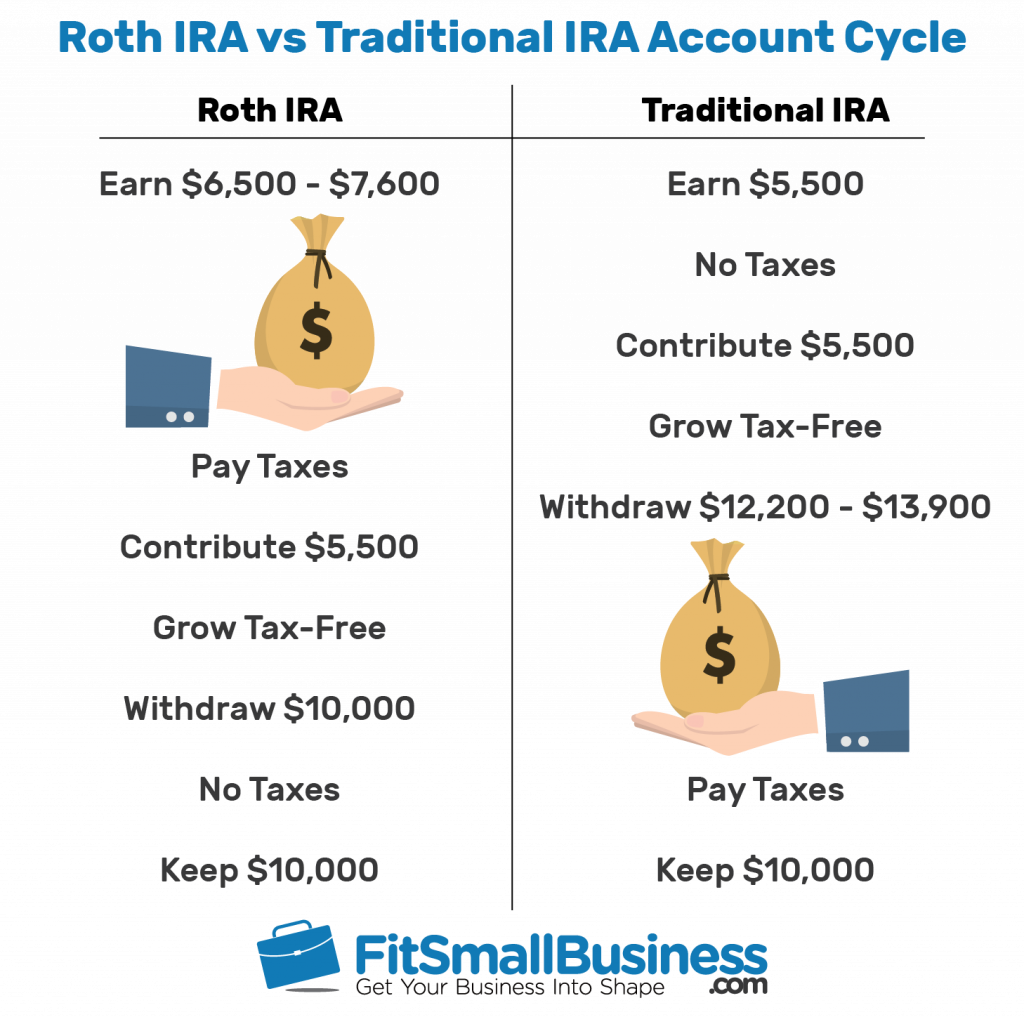

Because traditional iras and 401 (k)s have different tax.

If You're Age 50 And Older, You.

2025 roth ira contribution limits.